The top-of-summer decelerate is underway, with companies that staffed up within the spring now cutting down. Nevertheless, employee wages continued to rise as Predominant Road fights to retain good expertise amid a persistent labor scarcity.

Most small enterprise hourly employees are happy with their jobs and pay, as new priorities like schedule flexibility and crew relationships high the record. Employees are much less optimistic about future prospects, as inflation worries improve.

NEW AND NOTEWORTHY:

- Predominant Road wages continued to rise in August, regardless of wage cuts throughout massive industries like know-how and transportation, displaying that small companies are nonetheless battling the labor scarcity.

- Hospitality noticed solely a slight dip in workers working as groups thinned in direction of finish of summer time whereas nonetheless supporting higher demand than prior years.

- Constant summer time wage development has impacted employee priorities, with workers now valuing schedule flexibility & management and crew relationships over wages.

- Inflation stays a high concern for hourly employees (greater than 3x greater than dropping one’s job). Longer working hours have additionally been an growing fear.

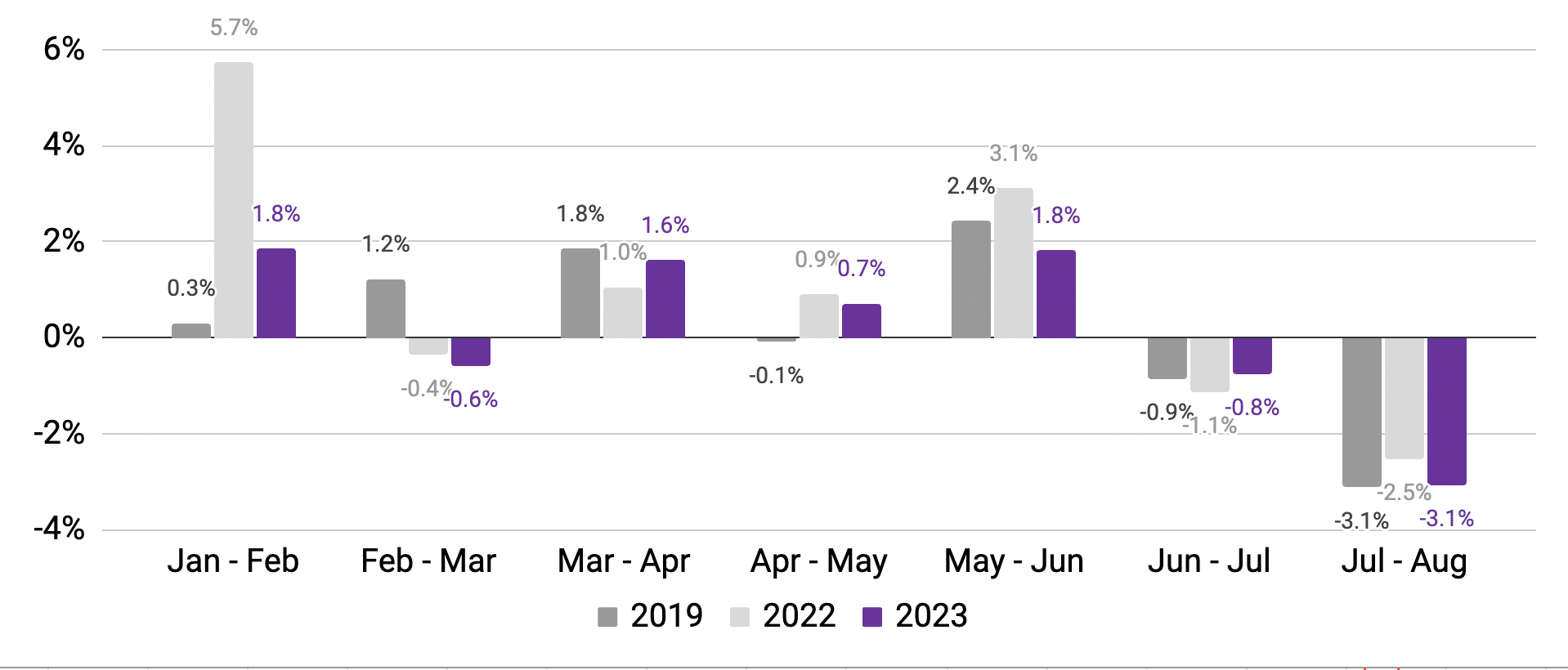

Summer season slowdown has begun, in line historic seasonal tendencies.

The variety of workers working and hours labored dropped from July on the similar price as prior years.

Staff working

(Month-to-month change in 7-day common, relative to January of reported 12 months)

Hours labored

(Month-to-month change in 7-day common, relative to January of reported 12 months)

Information compares rolling 7-day averages for weeks encompassing the twelfth of every month; April knowledge encompasses the next week to account for Easter vacation. Supply: Homebase knowledge.

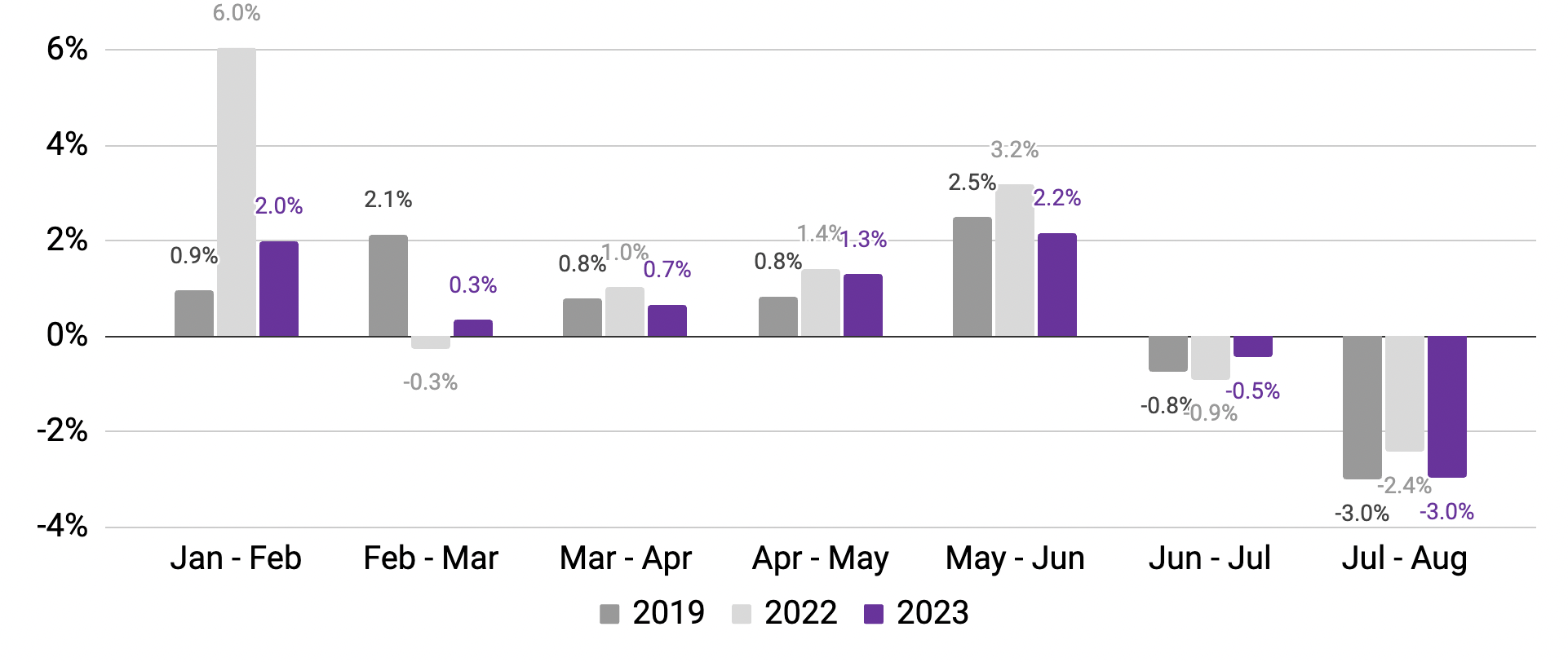

Impacts of the July warmth dome have cooled.

Reductions in workers working are not concentrated within the South.

Output by MSA

Month-over-month change in core financial indicators, by metropolitan statistical space

Notice: August 6-12 vs. July 9-15. Supply: Homebase knowledge

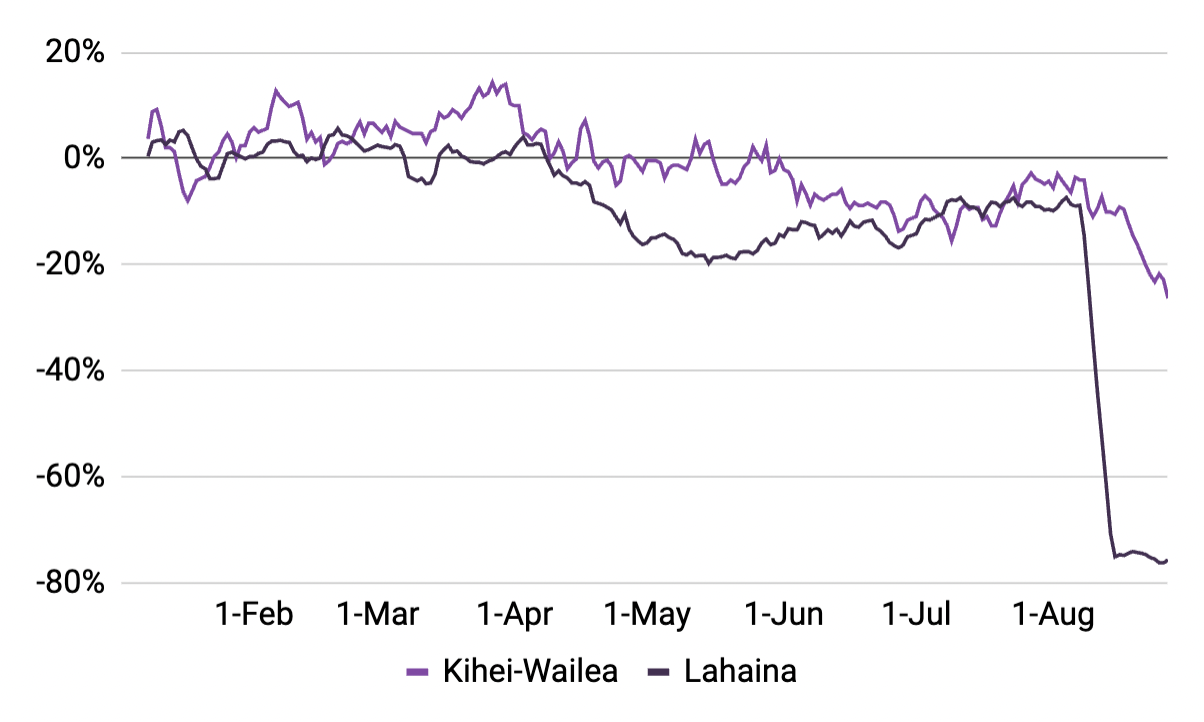

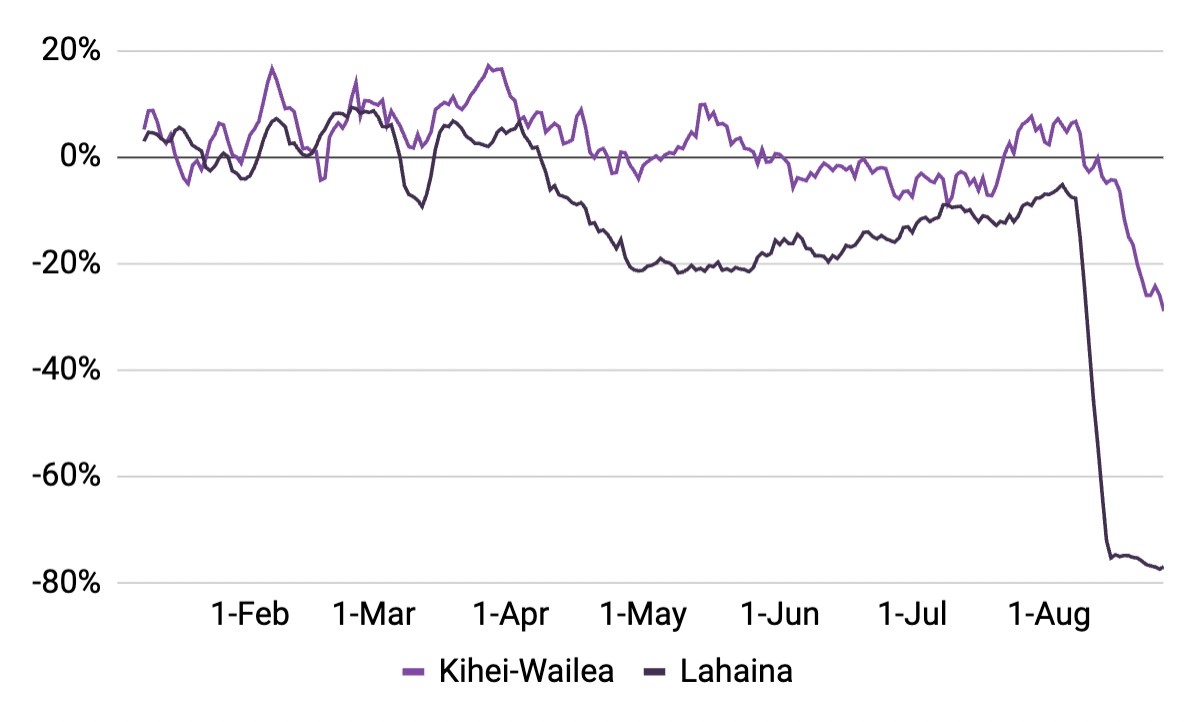

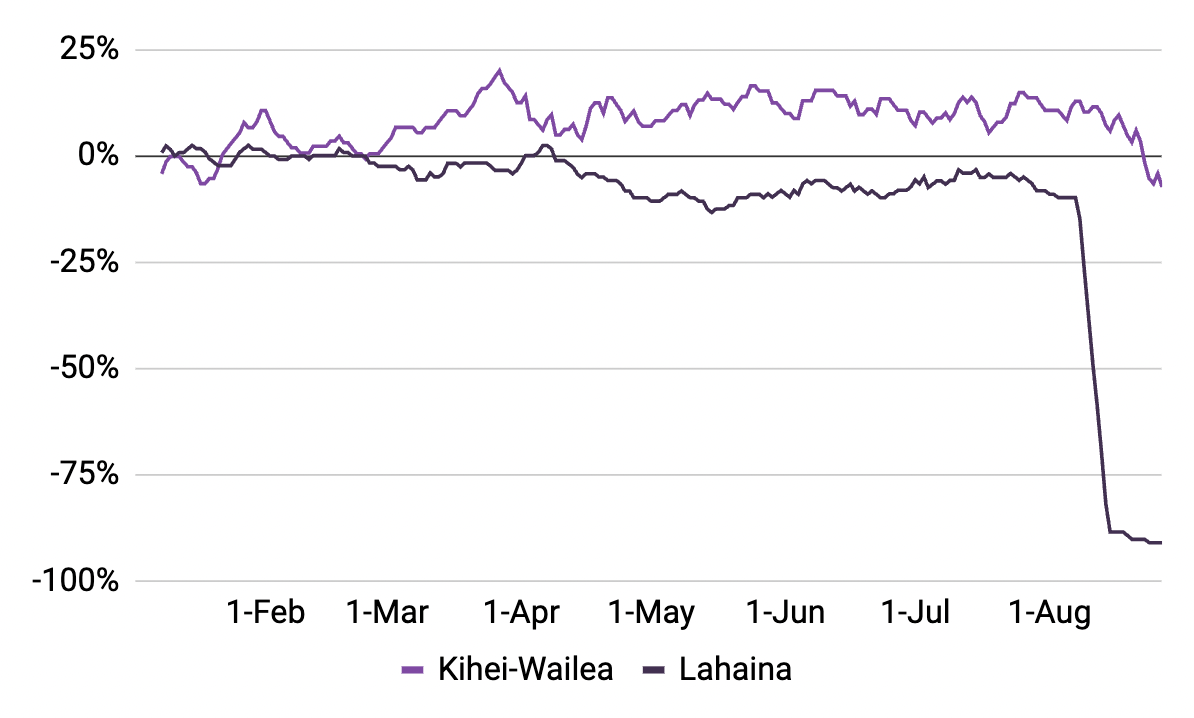

Nevertheless, the Lahaina fireplace has affected a lot of Maui’s Predominant Road.

August’s devastating fires in Lahaina destroyed native companies and compelled many others to shut their doorways and concentrate on security and restoration. Exterior of Lahaina, requires tourism to proceed in outlying cities, like Kihei and Wailea, encourage customer foot visitors for native companies which might be attempting to maintain their doorways open and groups gainfully employed.

Staff working

(Month-to-month change in 7-day avg, relative to January 2023)

Hours labored

(Month-to-month change in 7-day avg, relative to January 2023)

Companies open

(Month-to-month change in 7-day avg, relative to January 2023)

Notice: Information encompasses companies that operates within the census-designated locations (CDPs) of Kihei, Wailea, and Lahaina. Supply: Homebase knowledge.

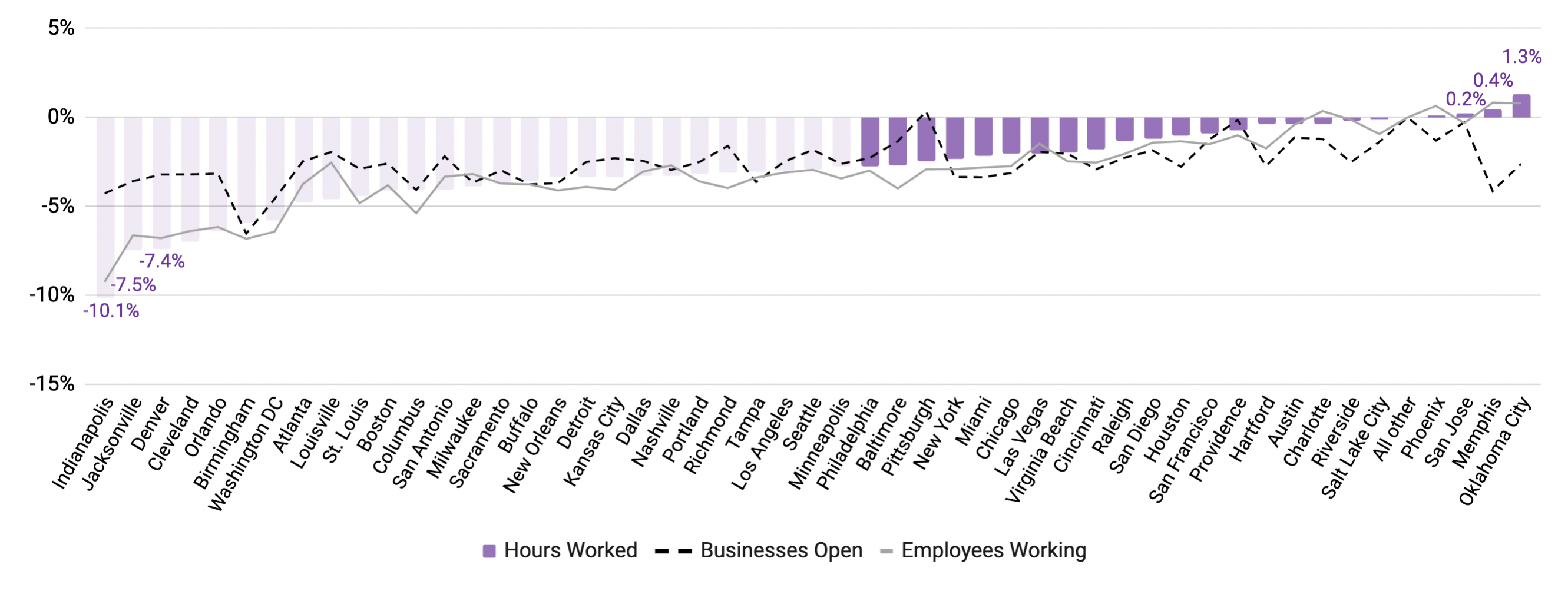

Fewer workers working is pushed by the transition from summer time holidays to back-to-school (and work).

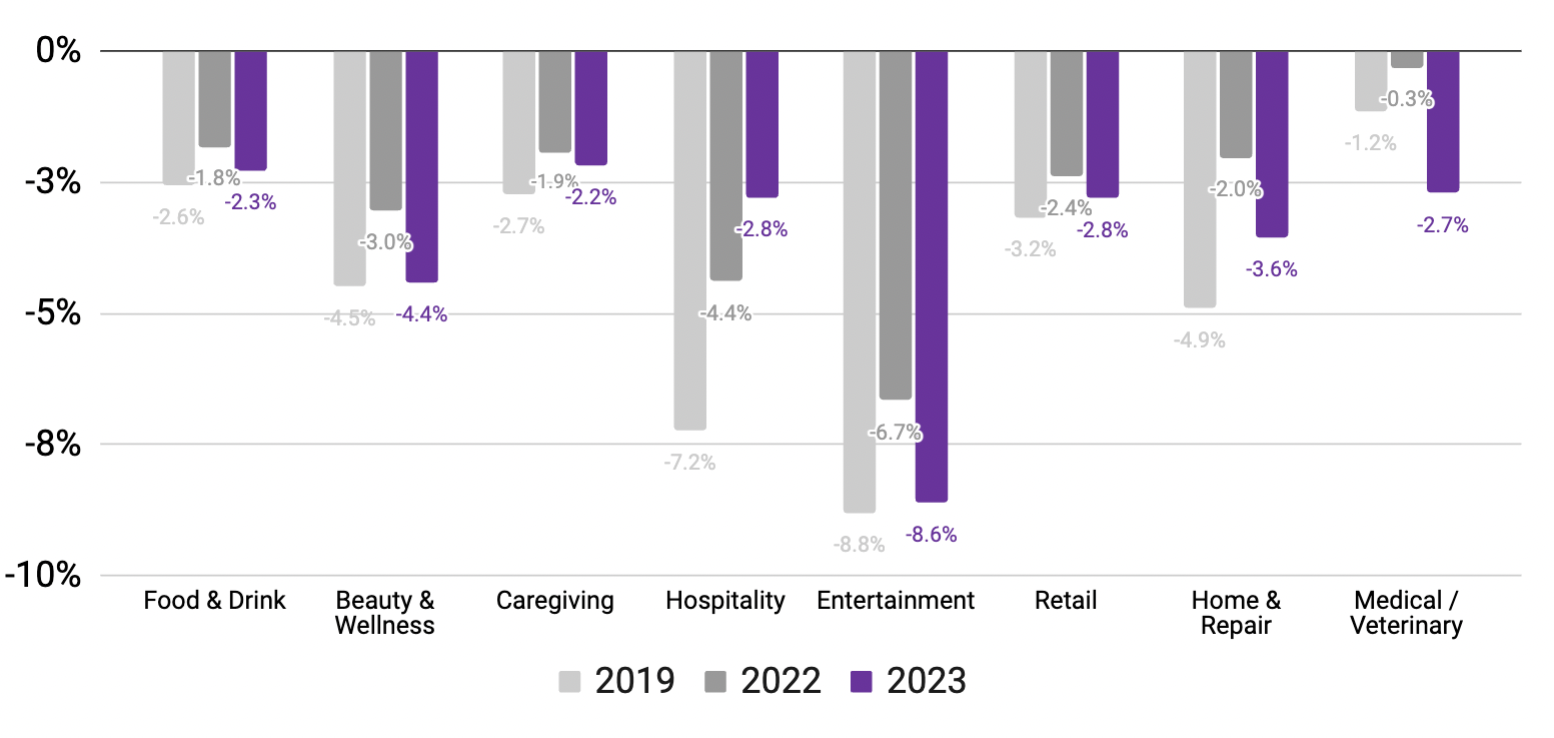

Hospitality companies noticed leaner groups in August than midsummer, however wanted extra employees to assist higher demand than prior years.

This 12 months, Hospitality1 noticed solely a slight dip in workers working in August, which is far lower than in prior years. That is possible resulting from early summer time labor shortages, which meant decrease hiring in June and July and thus smaller crew reductions in August (in comparison with earlier years).

Leisure2 noticed a stark however anticipated decline in workers, as the necessity for outside actions slowed according to prior years.

% change in workers working

(Mid-August vs. mid-July, utilizing Jan. ‘19, Jan. ‘22, and Jan. ‘23 baselines) 3

- Hospitality consists of tourism and resort/lodging companies.

- Leisure consists of occasions/festivals, sports activities/recreation, parks, film theaters, and different classes.

- August 11-17 vs. July 7-13 (2019); August 7-13 vs. July 10-16 (2022); August 6-12 vs. July 9-15 (2023). Supply: Homebase knowledge

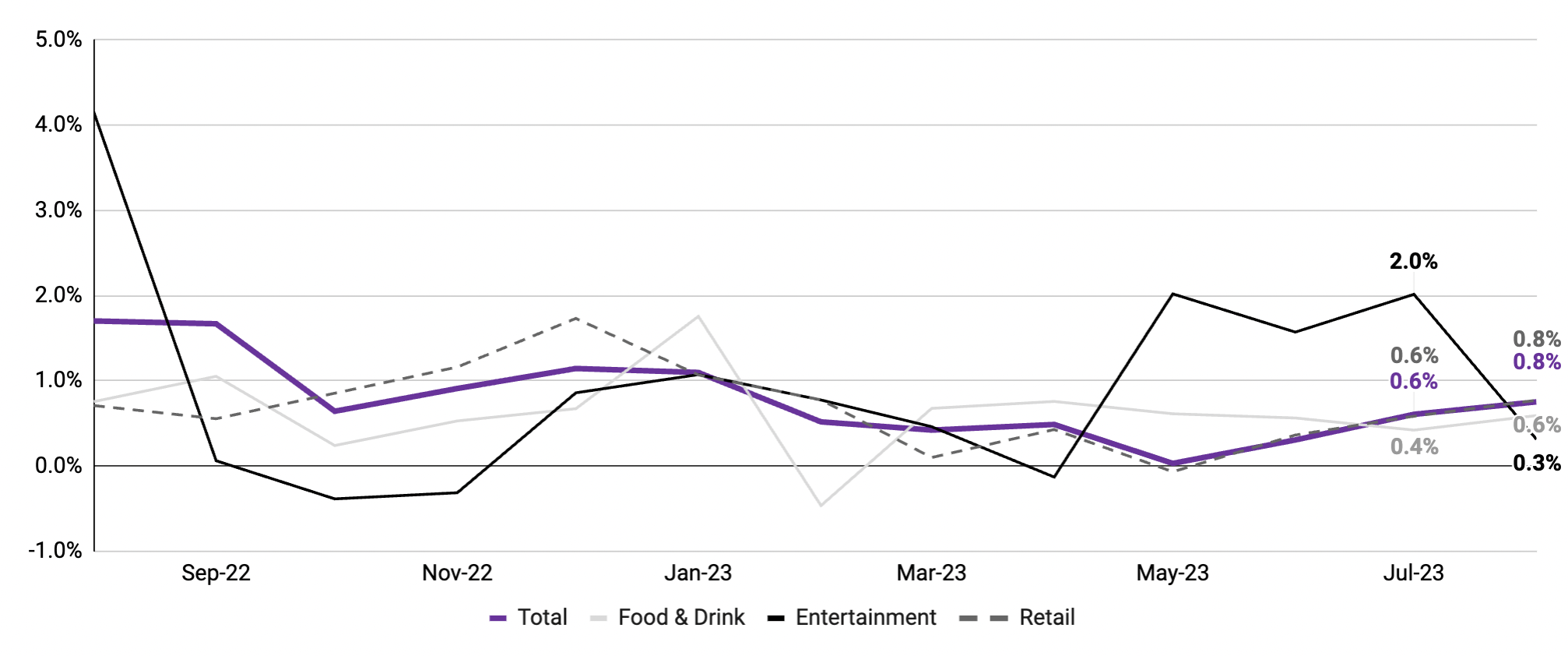

Wages at small companies grew much more in August than July.

Small companies proceed increase employees wages to retain seasoned groups within the face of labor shortages.

Avg. wage adjustments, m/m

Month-to-month change in common hourly wages throughout all jobs

Hourly Worker Pulse Test

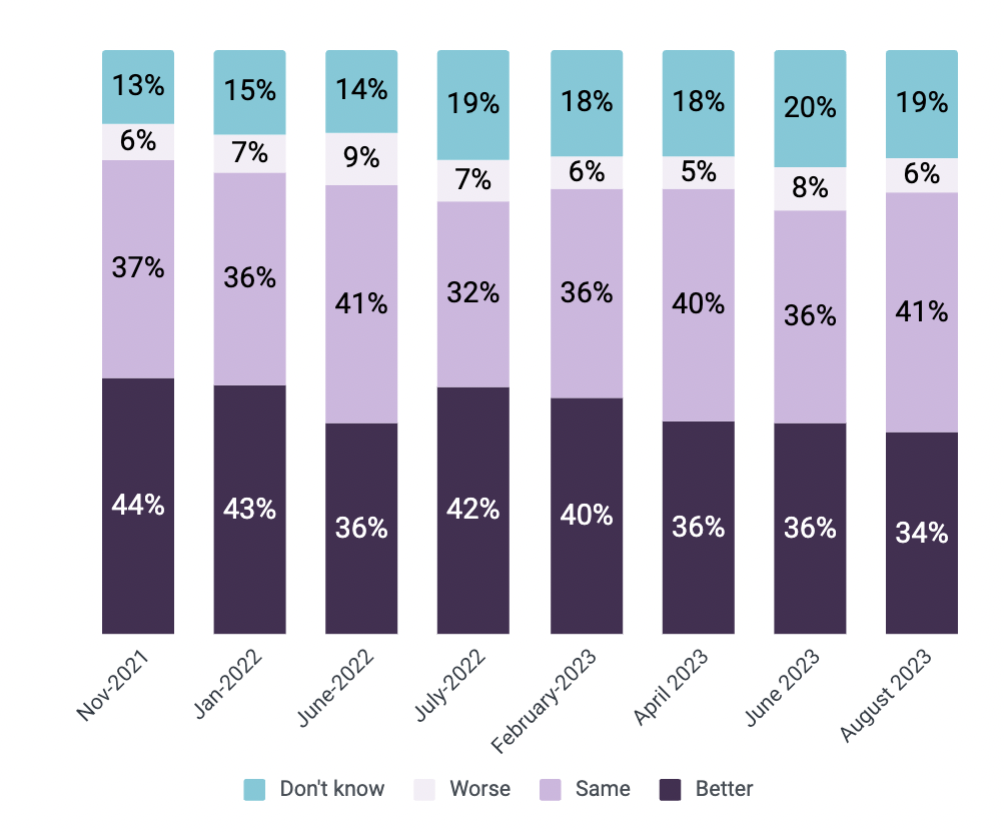

Hourly employees are much less optimistic about future job choices.

Whilst wages proceed to develop and labor stays tight on Predominant Road, employee optimism is reducing and uncertainty is step by step on the rise. That is possible pushed by basic financial instability or tales within the media.

34% of hourly employees suppose their job choices will likely be higher in 12 months. This price has been steadily declining since July 2022 when it was at 42%.

Survey query: Do you suppose your job choices will likely be higher, about the identical, or worse in 12 months in comparison with immediately?

Supply: Homebase Worker Pulse Survey

N = 873 (Feb. ‘23); N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23)

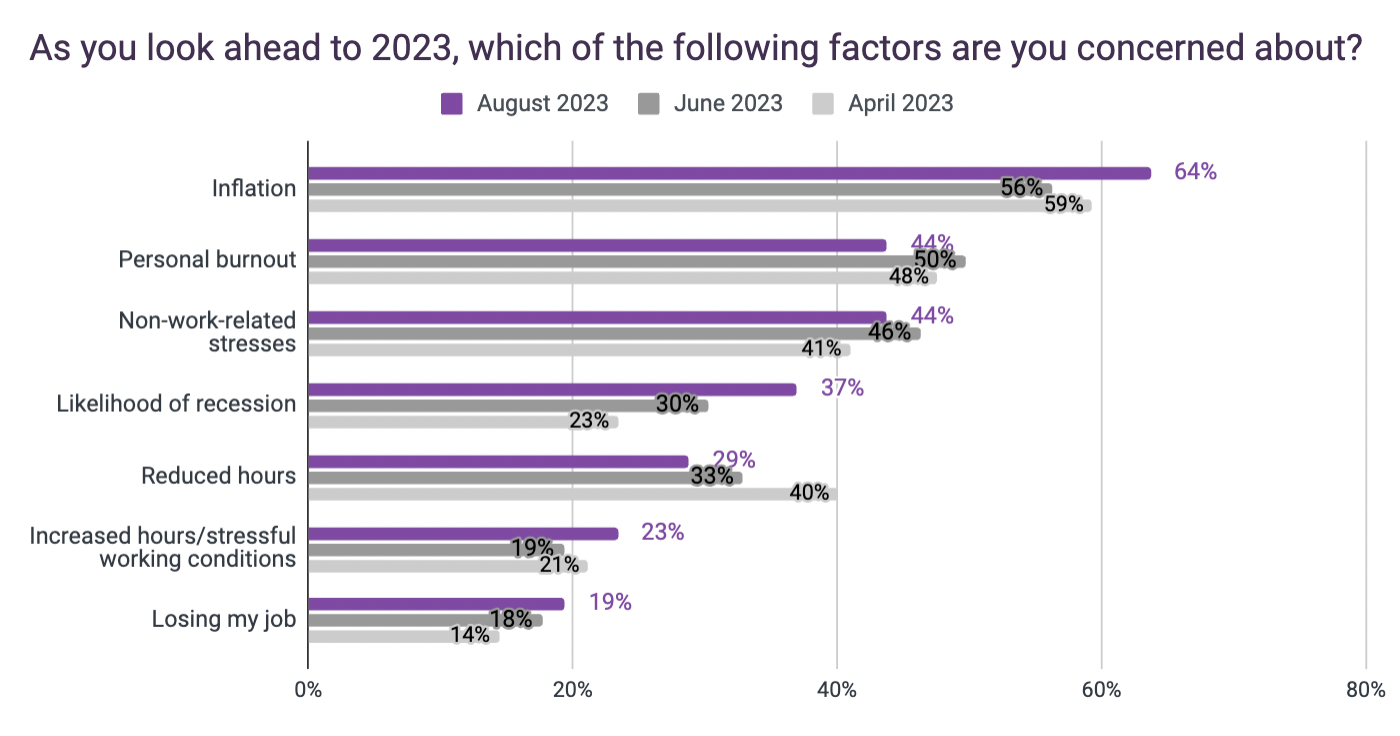

Employees are 3x extra involved about inflation than dropping their jobs.

Inflation stays a high concern in 2023, as the price of residing rises. In August, 64% of hourly employees reported caring about inflation, a rise of almost 10% from June.

Longer working hours for workers additionally look like on the rise. Employees are extra anxious about elevated hours (23% in August, up from 19% in June), and are much less anxious about decreased hours (29% in August, down from 33% in June).

Supply: Homebase Worker Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23)

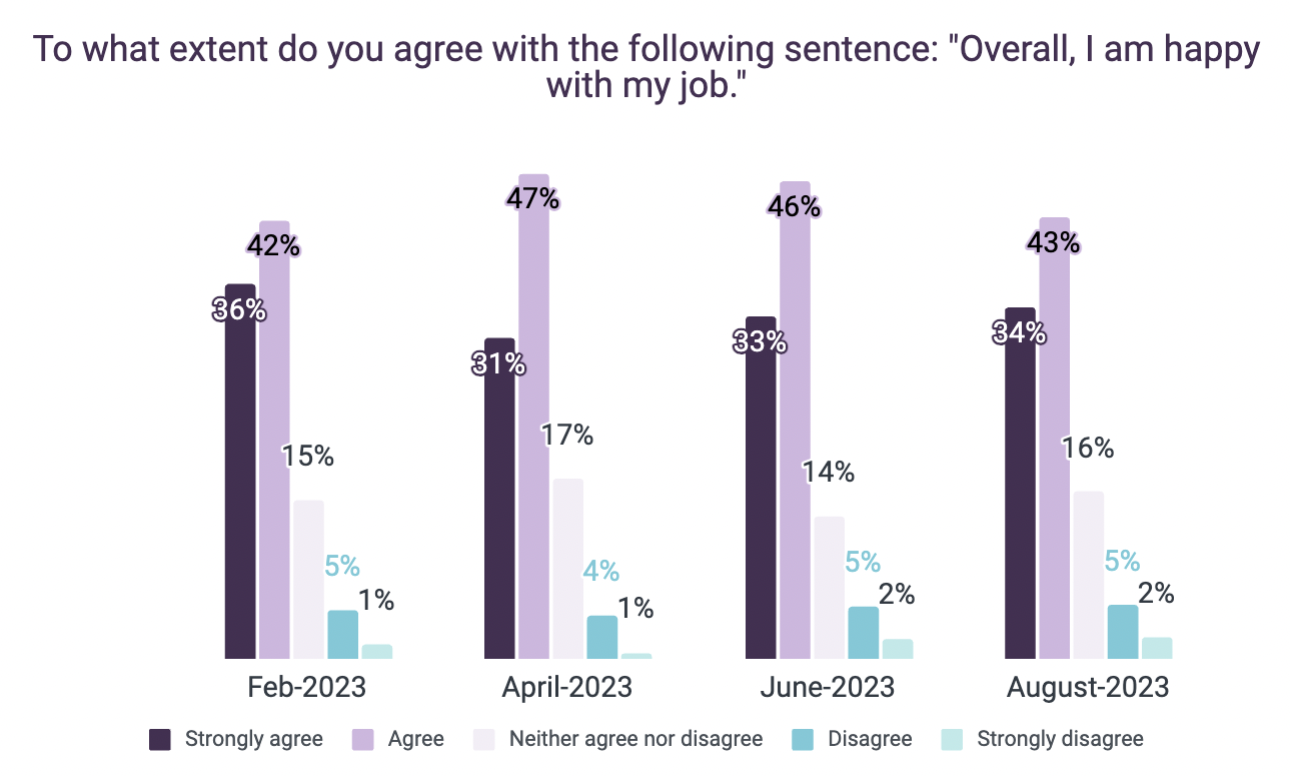

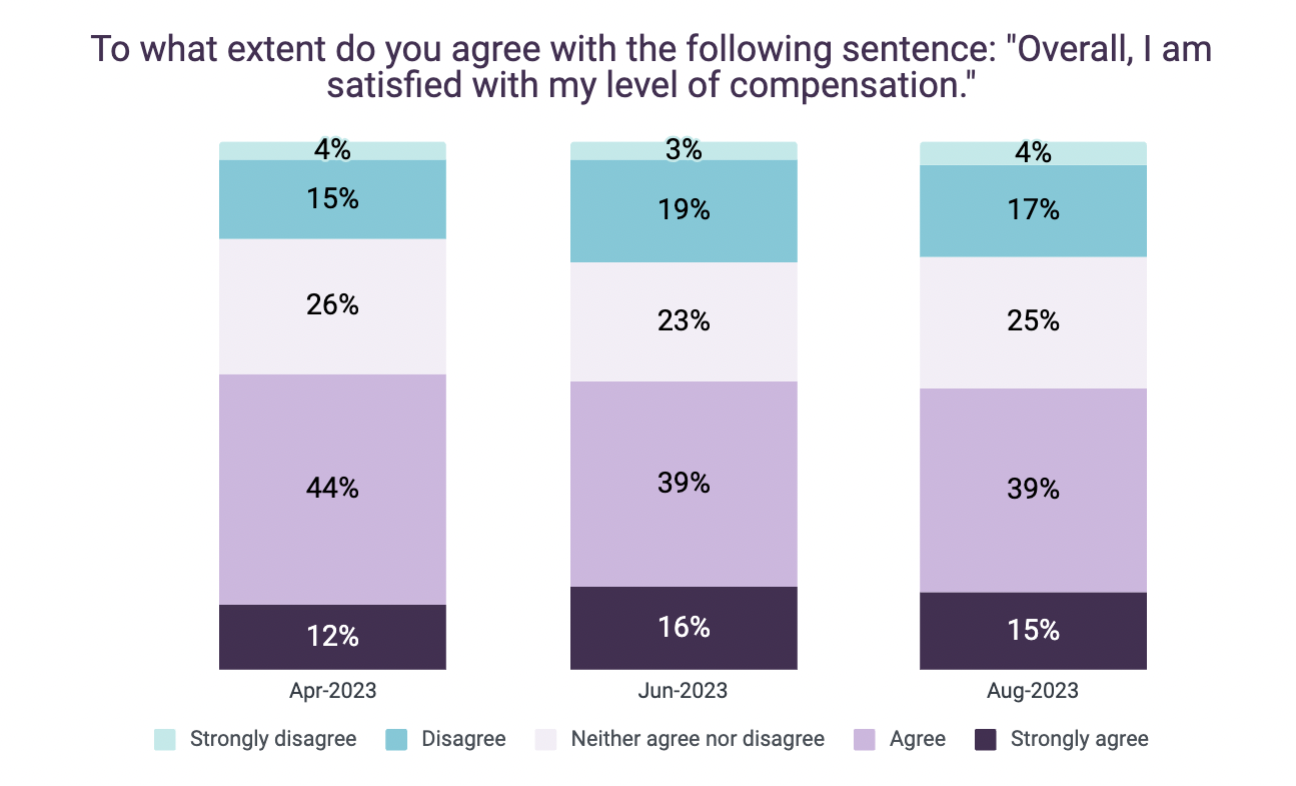

Job satisfaction on Predominant Road is constantly excessive.

As many as 4 out of 5 hourly employees agree they’re pleased with their jobs total.

Their outlook on wages has remained usually constant. In August 2023, 54% of hourly employees at small companies mentioned they had been happy with their compensation.

Supply: Homebase Worker Pulse Survey

N = 873 (Feb. ‘23); N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23)

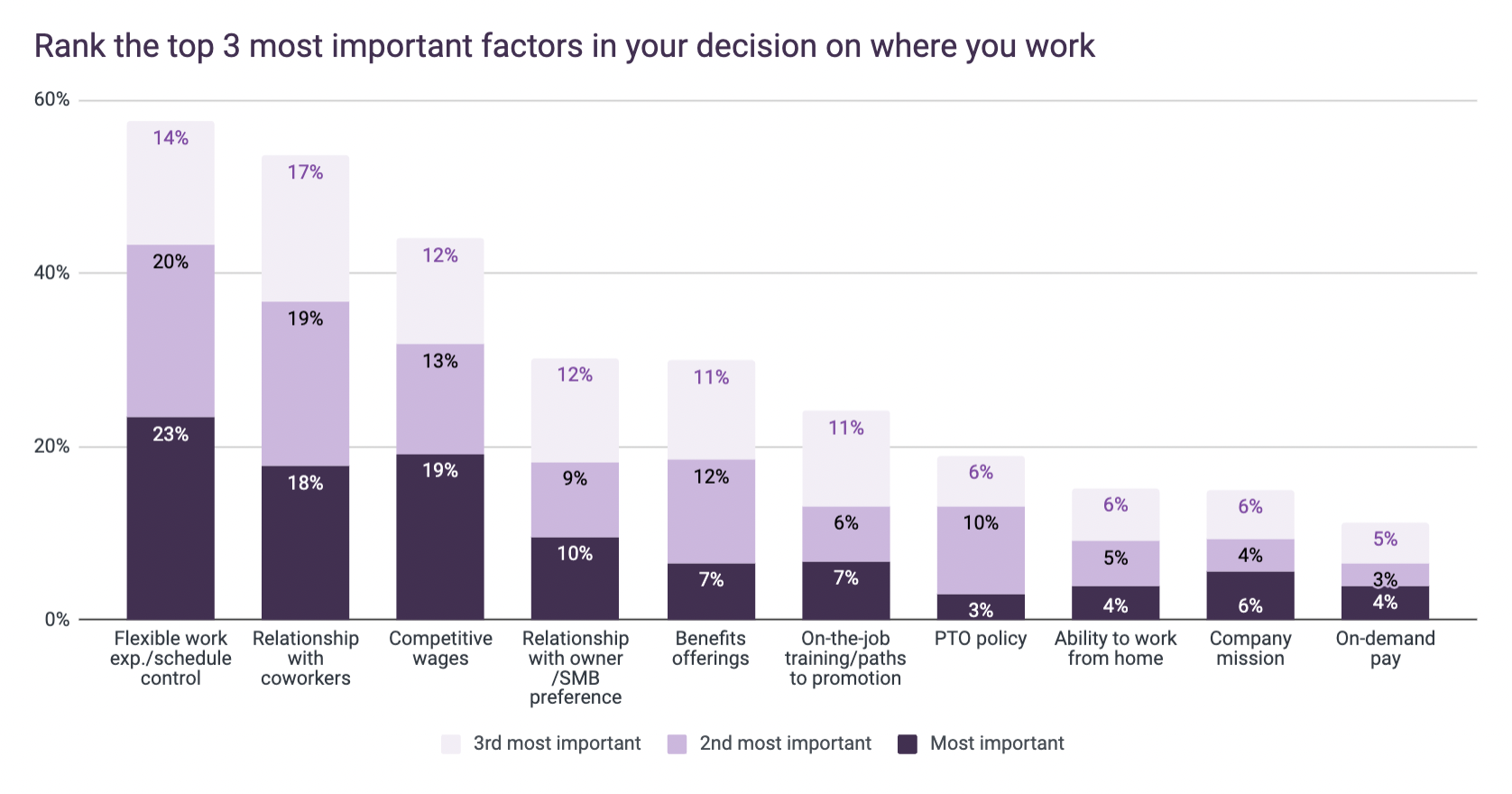

It’s about extra than simply cash, say hourly employees.

Flexibility & schedule management and crew relationships are crucial elements for workers.

Since Might, wage development has impacted hourly employee priorities, with schedule flexibility and crew relationships constantly rating above wages.

Supply: Homebase Worker Pulse Survey. N = 666 (Apr. ‘23); N = 611 (Jun. ‘23); N = 427 (Aug. ‘23)

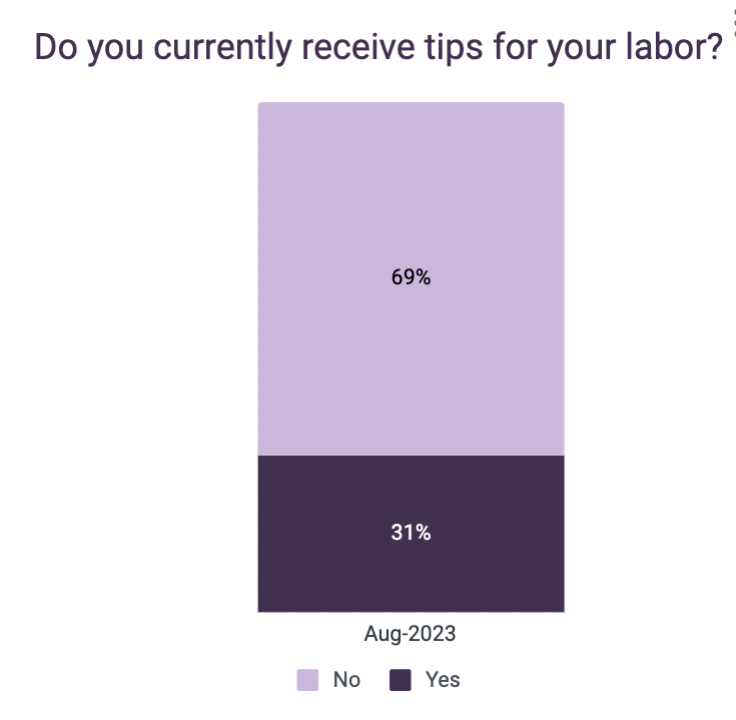

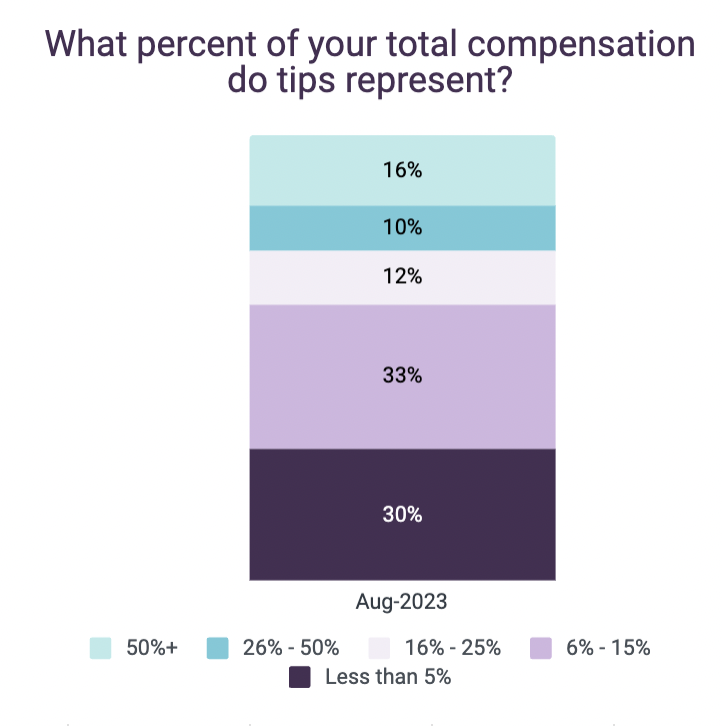

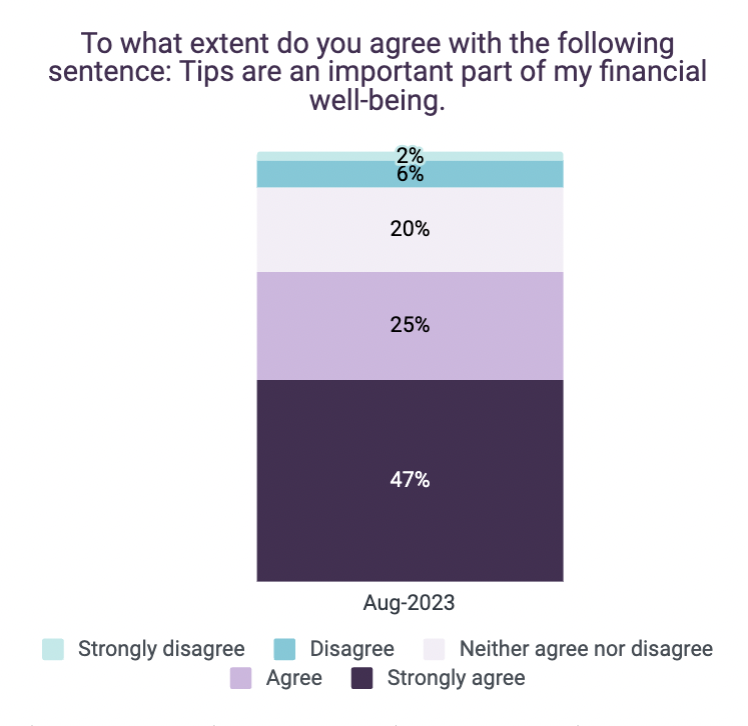

For employees who obtain ideas, they’re a important part of compensation.

Supply: Homebase Worker Pulse Survey. N = 427 (Aug. ‘23)

Hyperlink to PDF of: August 2023 Homebase Predominant Road Well being Report. Should you select to make use of this knowledge for analysis or reporting functions, please cite Homebase.