As a small enterprise proprietor, monetary planning can really feel overwhelming.

However monetary planning is essential for small companies. Not solely does it offer you a complete overview of your monetary well being, however it helps you determine how one can develop and develop your online business as effectively as attainable.

There are numerous budgeting and forecasting software program for small companies that may estimate future income and bills by planning the monetary assets you want.

What’s small enterprise monetary planning?

Small enterprise monetary planning is the method of reviewing income, turnover, property, capital, stock, and the rest regarding a enterprise’s monetary affairs. It summarizes the monetary well being of a enterprise and descriptions its monetary objectives for the long run.

Whether or not it is a long-term funding plan or a short-term plan for income development, your monetary plan can be clear as to what your objectives are and how one can plan to realize them.

On this article, we’ll talk about every thing you could learn about monetary planning as a small enterprise. We’ll cowl what monetary planning is, whether or not you want a monetary advisor, and how one can create a strong monetary plan for your online business.

We’ve additionally received some useful ideas for monetary planning as a small enterprise and an summary of some important issues to keep in mind when making a monetary plan.

Why is monetary planning necessary for a small enterprise?

You simply completed registering your online business by a certified registered agent. Now, you’ve received quite a bit in your plate operating the precise enterprise, and finance is a posh topic. Listed here are just a few causes to plan your funds:

- Understanding your monetary scenario: As a small-to-mid-size enterprise, it’s necessary to have clear oversight of your monetary well being. With oversight of your funds, you’ll know what assets you could have accessible, what areas of your online business are doing nicely, and what areas want enchancment.

- Figuring out areas of development: Monetary planning is an effective way to establish areas of development. It exhibits you the place you’ll be able to enhance your online business and how one can spend your cash. And as a small enterprise proprietor, you could be sure to’re spending your cash as effectively as attainable.

- Enthusiastic about the long run: Monetary planning is the right alternative to consider the long-term development of your small enterprise. You possibly can create a step-by-step plan to get from the place you are actually to the place you need to be.

Do you want a monetary advisor as a small enterprise proprietor?

A monetary advisor helps you make knowledgeable choices about what to do together with your cash and different property.

However the query is: do you want one? Briefly, no. You don’t want a monetary advisor. However there are advantages to utilizing one when you’re operating a small enterprise.

These embrace:

- Saving time: With a monetary advisor taking good care of your cash, you’ll be able to spend much less time managing your funds and extra time operating your online business.

- Evaluating market developments: Monetary advisors know the business inside and outside. They’re on prime of all the most recent financial developments that affect the best way you run your online business.

- Saving cash: Utilizing a monetary advisor isn’t low-cost, however it may possibly assist you to lower your expenses in the long term. With such a variety of business information, they’ll discover methods you’ll be able to lower prices that you simply may not have thought-about.

Regardless that a monetary advisor isn’t a necessity, there are actually causes you must consider using one as a small enterprise proprietor. It’d seem to be some huge cash to spend, however it’ll prevent each money and time.

How you can craft a robust monetary plan to your small enterprise

Sadly, there is not a one-track system to create a profitable monetary plan. Each firm is completely different, which suggests monetary plans change from enterprise to enterprise. However there are some greatest practices you’ll be able to comply with to verify your monetary plan is as robust and steady as attainable.

Establish any capital required

First issues first, you should establish the capital you could assist your online business develop. Realizing what capital you want helps you intend your funds extra effectively and maximize your assets.

To not point out, it permits small enterprise homeowners to determine how a lot they’ve (by way of cash, assets, and property) as compared with what they want.

So how will you establish the capital you want? First, you could determine what capital you have already got. This gives you a strong place to begin to search out the capital you could get to the place you need to be.

Spend a while reviewing what your online business already has, and go from there. As soon as you understand what assets you could have accessible, you’ll be able to take into consideration what capital you want.

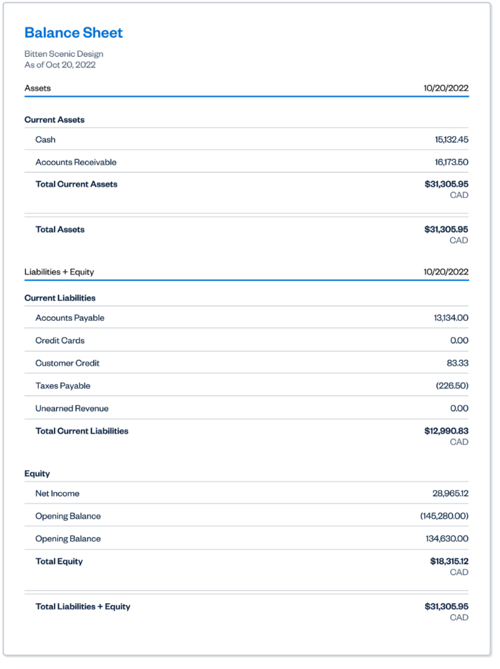

Create a steadiness sheet

A steadiness sheet reveals your organization’s property, liabilities, and fairness. It provides your liabilities (any debt or losses) to your fairness (what your online business is value) to find out the worth of your property.

Right here’s an instance of a steadiness sheet in motion:

When mixed with different paperwork, equivalent to an earnings assertion or money circulation assertion, small enterprise homeowners get a fairly clear image of their monetary well being.

How are you going to create a steadiness sheet? Comply with these steps to create your individual:

- Checklist all of your property together with their present market worth

- Define all of your money owed and liabilities

- Subtract the worth of your liabilities from the entire worth of all of your property

What you’re left with is the fairness (internet value) of the enterprise.

To maintain issues easy, the free steadiness sheet template can also be accessible.

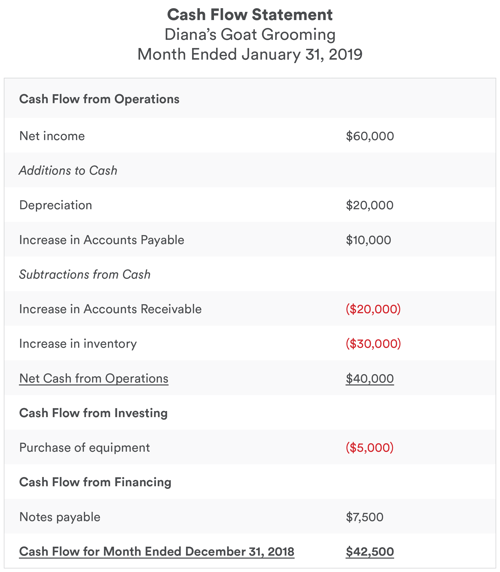

Produce a money circulation assertion

As a small enterprise proprietor, it’s necessary to maintain on prime of your working money circulation.

Having a wholesome money circulation is a crucial a part of operating a profitable enterprise. It provides you a buffer for emergencies, permits you to pay your staff on time, and supplies you with the funds you could run your online business.

To maintain monitor of your money circulation, you could create a money circulation assertion. A money circulation assertion is a monetary doc that summarizes all of the money going out and in of your organization. It exhibits how the corporate’s operations are operating, the place cash is coming from, and the way it’s being spent.

Right here’s an instance:

With a money circulation assertion in place, you’ll be able to simply measure how nicely your organization manages its money place.

Venture your future earnings

A part of the monetary planning course of includes projecting your future earnings. Probably the most environment friendly method to do that is to create an earnings forecast. Primarily based on how your organization has carried out previously, you make predictions about future earnings over a particular interval.

In different phrases, you employ previous information to foretell your future earnings.

However how is this convenient for a small enterprise? There are just a few methods:

- Discover your future objectives: Forecasting helps you determine the place you need your organization to be additional down the street and map out the journey to get there.

- Align your crew: If you conduct an earnings forecast, you create a objective for everybody to work towards. By doing this, you align your organization to hit sure targets.

- Present buyers your roadmap: As a small enterprise, you could be excited about getting buyers concerned. An earnings forecast outlines the course of your online business growth, which buyers will definitely need to see.

Monetary planning concerns small companies make

On your define, you solely want bullet level descriptions of content material you intend to write down. In the case of monetary planning, there are particular concerns small companies must remember the fact that massive firms received’t.

Or if a big company must take the identical consideration, they’ll in all probability evaluate it from a completely completely different perspective. Let’s check out a few of the monetary planning concerns you want to pay attention to as a small enterprise proprietor.

1. Retirement planning

We all know what you’re pondering. Isn’t retirement planning necessary for each enterprise, not simply small companies? You’re proper. Each enterprise proprietor ought to take into consideration retirement planning. However small enterprise homeowners must do it sooner relatively than later.

Massive companies have retirement planning and processes in place for workers. However as a small enterprise proprietor, this job is as much as you.

Listed here are a few issues to consider relating to retirement planning:

- Distribute your funds: Getting ready for retirement includes saving, distributing, and investing your cash. The most typical investments are often retirement accounts, which let you develop your cash with tax advantages and curiosity. Should you’re freely giving any property to pals or household, remember to verify whether or not they’re tax deductible.

- Create a will or belief: Retirement planning takes life expectancy under consideration. Having a dwelling will or belief in place will defend your property within the occasion of an accident or incapacitation.

Get your geese in a row as quickly as attainable to be sure to can take pleasure in a protracted and comfortable retirement. The earlier you issue it into your monetary plan, the extra likelihood you’ll attain your objective.

2. Danger administration

Each enterprise faces threat. Whether or not that’s shedding market share to a brand new competitor or taking a success in product gross sales, there’s all the time a risk issues received’t go to plan.

However the potential loss for a small enterprise could be detrimental when you don’t have a threat administration plan. A threat administration plan outlines the attainable monetary points your online business may face and how one can mitigate them. This may be certain that you’re ready for the worst-case situation.

And when you’re excited about getting an investor on board, they’ll be happy to know you could have a plan to deal with any challenges that come your method.

So relating to your monetary planning, be sure to take into consideration integrating a threat administration plan, too. It’d seem to be numerous effort, but when issues don’t go your method, you’ll be glad to have a plan of motion in place.

3. Tax planning

Nobody needs surprising fines and fees, particularly when you’re a small enterprise. A big positive from the authorities could possibly be the distinction between a profitable yr or chopping prices throughout the corporate.

Luckily, that is the place tax planning can assist.

Tax planning includes organizing your funds in essentially the most tax-efficient method. It identifies areas the place it can save you cash and declare a reimbursement. It additionally reduces your chance of getting undesirable fines. In consequence, you’ll be able to put more cash again into your online business. And as a small enterprise, the more cash you’ll be able to put money into your development, the higher.

Should you’re undecided the place to start out with tax planning, don’t fear. There’s numerous tax software program on the market that may assist you to out.

Monetary planning ideas for small companies

We’ve coated numerous floor up to now, so let’s wrap issues up by 4 of our most helpful monetary planning ideas for small companies.

1. Evaluation your working bills

Working bills are prices incurred out of your core enterprise operations. For instance, the hire you pay to your workspace or your stock prices.

Taking inventory of your working bills permits you to establish the price of operating your online business, which is significant for monetary planning. With this data, you’ll be able to work out your internet revenue. This implies you’ll be able to determine how a lot cash you could have leftover after all of your bills are settled.

And as a small enterprise, maintaining on prime of your internet revenue is the important thing to success. With out an SMB accounting system, you received’t know what cash you could have accessible, which may end in overspending.

Should you’re undecided the place to start out, there are many expense administration platforms on the market to make the job simpler.

2. Define your online business objectives

Clearly outlining your online business objectives provides your monetary planning course. When you could have firm objectives in place, you’ll be able to tailor your monetary plan to realize these objectives.

Think about your online business objective is to extend your annual turnover by 10% inside the subsequent yr. In consequence, your monetary plan outlines how one can lower prices on manufacturing to supply a cheaper price to shoppers.

Check out the pricing web page from ActiveCampaign. This software program is completely on-line, that means it may possibly provide companies for a really affordable worth.

Providing a cheaper price has the next likelihood of accelerating your conversions and getting the next annual turnover.

Be sure to’re clear on what your organization objectives are earlier than you create a monetary plan. By aligning enterprise objectives with the monetary planning course of, you could have the next likelihood of reaching them.

3. Think about your funding choices

Should you haven’t already, be sure to discover the loans and grants which might be accessible to small companies.

Securing funding can assist you reinvest your capital, develop your organization, and enhance your monetary well being. The excellent news is that there’s quite a lot of funding choices on the market for small companies.

Organizations such because the U.S. Small Enterprise Affiliation and the U.S. Authorities (amongst others) provide funding choices for small companies. You’ve received nothing to lose by making use of, so check out what’s on the market.

4. Construct your credit score rating

Should you think about funding or funding, you don’t need poor enterprise credit score to be an issue. Traders and shareholders aren’t going to put money into a enterprise with a bad credit report rating. It may additionally trigger issues with acquisitions and different enterprise transactions additional down the street.

So what are you able to do to enhance your credit score rating and maintain it robust? Pay your payments on time. Do not miss bank card funds. Do not settle for any loans with rates of interest you’ll be able to’t afford. This may be sure that your credit standing stays above the road.

When cents make sense

You’ve now received a fairly strong understanding of small enterprise monetary planning and a few greatest practices to comply with when making a monetary plan.

Now it’s time to place all this data into observe.

Should you’re anxious about taking over this arduous job, don’t be. There are methods to make the method simpler to handle. With the proper platform, you’ll be able to streamline the planning course of and maintain every thing saved in a single location.

Check out the greatest monetary evaluation software program for small companies to observe your monetary efficiency effectively.